Welcome to “Artist as Debtor,” a conference on the all-too-familiar topic of art-school debt. Throughout the day, our staff will be liveblogging some of the half-hour talks on the subject by Andrew Ross, Brian Kuan Wood and Julieta Aranda (e-flux), BFAMFAPhD, Powhida, Debtfair, Greg Sholette, W.A.G.E, Coco Fusco, and Martha Rosler (see the schedule and follow the livestream here).

So it’s a lot of the usual suspects, but I’m particularly excited to hear from Gregory Scholette, after reading his co-edited book Collectivism After Modernism, a compilation of essays about the history of collectivist art making. I’d never heard of most of the artists in the book, though their social impacts are far more relevant to the history of the past 50 years than the usual Chelsea narratives. A must-read. Tune in to hear him at 4:30.

4:43 My head is resting on my speakers. I can’t properly quote Scholette, so I can’t blog it.

4:35 Gregory Scholette takes the podium (Whitney here)

Kenneth, a presenter from Debt Fair.

4:35 I have to say, this panel was pretty impressive for its thoroughness. There’s a cliche that artists don’t do numbers, but BFAMFAPHD in particular really challenges that idea. And I think a lot of that comes out of necessity. Artists can’t afford to get out of school more than $100,000 in debt, because their careers won’t support that. And I’m sorry, but all that cultural capital you get from being an artist doesn’t pay your student loans. If there’s one message that American Realness brought home last week, it was that. (Paddy)

4:30 As a possible means of redistributing some of the money in the art market, William Powhida is claiming there is legislative support for artist resale royalty rights, which isn’t true. That support died in congress last week.

4:25 Q&A: Was there a problem with a tax burden for large barters at Debtfair? Answer: Well, we’re artists so we don’t have all the answers. (Paddy here) Generally speaking, I’d like to see artists work more collaboratively with professionals outside their own field. Accountants are our friends!

4:15 Presentation concludes with statement “The only way forward is solidarity”

4:10 They want to present a different model to address the debt problem. In 2013, The Abrons Art Center hosted their event. Participants were encouraged to share their debt stories, and they set up an art barter system, where artists could exchange art for debt payments.

Debtfair convo begins

4:07 How do we draw money out of this $500 million pool so we can get it trickle down? Powhida says he doesn’t subscribe to trickle down economics, but wants to avoid the 80/20 split. WAGE is mentioned as a group also working to find new ways to distribute wealth.

4:05 Powhida is drawing from his essay on Creative Time. Read it here.

3:56 Powhida is talking about how economics blogger Felix Salmon estimates 1 billion to auction, the other two to primary market and secondary. If you split that number with dealers, you get 500,000 million million to artists.

Now, let’s say there are 10,000 visual artists represented in the city. They do a 80/20 split, which is generally accepted economic formula about how money often gets divided.

William Powhida begins his presentation

3:55 Woolard says they’re not suggesting that students drop out, but they are recommending that students take low cost options. But what are those options? Public school prices are on the rise and independent options are often short lived enterprises.

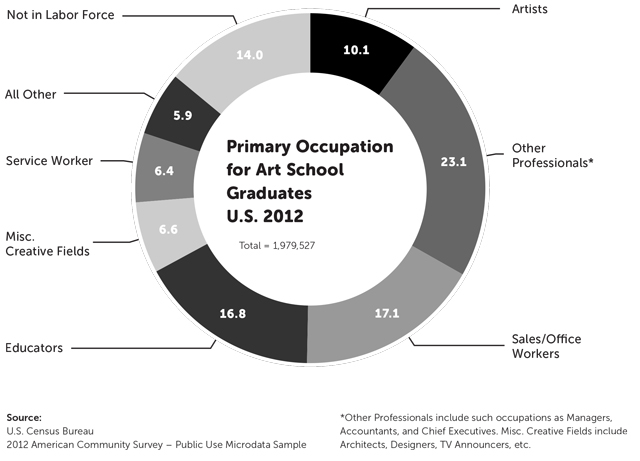

3:50 How do we define artists? What will help working artists defined by primary occupation and recent grads. Woolard admits these methods are not perfect, but let’s be honest, it’s a great start. 1 in 10 arts graduates is a working artist. 40 percent of people who make their living off art have no degree at all.

3:48 Woolard students at NYU paid $40,000 after scholarships. Woolard is paid $1850 for teaching one full course. Wooldard says NYU takes in 95 percent of the money.

3:45 Eek! 7 of the top ten most expensive schools are art schools. How much can artists expect to make back? Caroline Woolard is observing that while tuition rates have tripled, the staff has stayed the same.

3:40 (Paddy here) Introductions. Up first BFAMFAPhD. The group is made up of creatives, scientists, and any other profession. They are concerned with debt. What is a work of art in the age of $120,000 art degrees?

BFAMFAPhD, Powhida, Debtfair

BFAMFAPhD, Powhida, Debtfair

Corinna:

3:00 My thoughts: this is a little abstract right now.

Q & A: [Paraphrase] You don’t need to be in debt personally to feel the pains of being in debt. Our country is in debt. Public debt is passed on to the citizenry.

– How does debt affect an artist’s production? They create work that needs to be sold. *I think this is what she said; she’s on Skype, so it’s a little hard to hear.* (Julieta)

Q & A: How many of the organizers are in debt? Is there a moment where you’re too in-debt to be organized?

– Yes, there are some students who have to work too much to attend meetings.

– Buying debt with property seems to be something to be proud of, but it seems to be a dangerous road to be walking on. I guess it would make sense to describe some of the things we’ve been thinking about that ends up with finding figures that can try to understand what’s actually happening to our minds and bodies with financialization, but when capital becomes so abstracted, it absorbs the gift economy, strength, resistance… (Brian)

Because the language of this essay involves so much word play, I’m not exactly sure what’s going on. But I think the end of this essay refers to those students who gain debt (but not credit). Are these PhD students, liberal arts students? They want to plan, but they don’t need credit to build some sort of a bastion to the future.

Policy says they can’t handle debt and will never get credit. But if you listen to them, they will tell you: we will not handle credit, and we cannot handle debt, debt flows through us, and there’s no time to tell you everything, so much bad debt, so much to forget and remember again. But if we listen to them, they will say, “Come, let’s plan something together.” And that’s what we’re going to do. We’re telling all of you, but we’re not telling anyone else.

I’m having a difficult time reading this essay at the same pace as Brian (I’m guessing this is Brian Kuan Wood.), so I’m pretty much just reading from e-flux.

– People with bad debt do not fit into society. (They’re not citizens, they’re like lepers.)

– Debt is confusing, ; the language of the essay reflects this:

Only debt is productive, only debt makes credit possible, only debt allows credit to rule. Productivity always precedes rule, even if the students of governance do not understand this, and even if governance itself barely does. But rule does come, and today it is called policy, the reign of precarity.

Here’s a selection that reads like a sci-fi bad-debt future in Game of Thrones:

There will be a celebration when the North spends its own money and is left with nothing, and spends again, on credit, on stolen cards, on account of a friend who knows he will never again see what he lent. There will be a celebration when the Global South does not get credit for discounted contributions to world civilization and commerce, but keeps its debts, changes them only for the debts of others, a swap between those who never intend to pay, who will never be allowed to pay, in a bar in Penang, in Port of Spain, in Bandung, where your credit is no good.

Corinna: This is a live reading of Fred Moten and Stefano Harney’s “Debt and Study,” an essay published in e-flux #14 from March 2010. So read along with it here while listening to the reading; it’ll help.

I wish I could hear what this person is saying. And I wish I could read what’s on the screen behind. There’s someone reading aloud, something about the market crashing, and a response from…someone else. I can’t hear everything, so I’ll just type out what I *can* hear.

– What use are my dreams to the trustees?

– So you will remember my future, like a pre-emptive Dropbox?

– No, no. [Trustee? Off-screen, on the phone]

– So what you’re saying is that exchange for this you’ll write off my debt?

– So what you’re saying is that I have to stay an artist even if I don’t like the work I’m making?

Noah comes on stage: It’s time for a 30-minute Q & A session with the day’s presenters so far.

Andrew Ross is asked how his students’ views toward debt have changed over the years.

Andrew Ross (very loosely quoted): They’re not inclined to stand up and identify themselves in the ways that mark them. I teach at NYU, with one of the highest student-debt numbers across the nation…I think things are changing, though….The psychology is a difficult one to overcome [for debtors]. With a mortgage, I don’t think of myself as a debtor; I think of myself as a homeowner….Taking debt relief for yourself belongs to a tradition of justice, not charity.

Whitney: 1:30 Now hearing from Andrew Ross, professor at NYU, Occupy member, and author of numerous books such as “Creditocracy”.

***Apologies for shitty transcription***

An overview of the debt situation.Ross begrudges hosting the conference at Cooper Union, given its board’s squandering of the school’s endowment and decision to charge tuition.

He points out the fact that the banking system’s designed to keep the public in debt “creditors don’t want you to pay debts entirely…in the same way that banks don’t want you to pay your monthly balance. They call [those people] ‘deadbeats'”.

“What they want are revolvers– people who don’t make ends meet, who pay the penalties…The idea is to keep you on the hook as long as possiblee, til you die. To make lifelong revolvers of all of us.”

This is a reason, he says, that parents and co-parents are now being asked to cosign on student loans.

Most interestingly, Ross ties student loans to the decline in state funding to higher education. “Colleges take more from student tuition than they do from all their state sources combined. Higher education is no longer seen as a public good by elected officials.”

Mentions a Canadian study showing that every hour spent in the studio = loss of income.

College graduates earn twice as much in a lifetime than those who just graduated high school, although only 30% of the jobs in the American workforce actually require a college degree.

“If you extrapolate from that, then you have to conclude that there’s an overproduction of college graduates…But…politicians keep saying we have to meet higher degree growth [to stay competitive with China and Japan]…there’s a chronic mismatch between degree growth policy…and a lack of any national economic policy to create high [growth?] jobs”.

Ross describes the Rolling Jubilee, in which an Occupy-related group raised “a shitload of money very fast- more than 750k” in order to buy cheap debt on the secondary market and abolish it. Unfortunately, the project was ended about 8 months ago because it was simply a project to “raise awareness”. I wish they’d keep it going.

Ross concludes that nobody’s debt, including artists’, is separated from the global problem. Cites Gulf Labor Coalition, which has pressured institutions like NYU, the Guggenheim, and the Louvre which are building new sites on slave labor in Abu Dhabi.

Comments on this entry are closed.