Here we are at Tax Day. Your taxes are filed. (They aren’t? Here’s an IRS extension form – postmark it today. You’ll need one for your state, too.)

Last year you vowed to get your stuff in order. Then suddenly the tax deadline was upon you, and you scrambled through the process, and weren’t as careful as you intended to be. You suspected you should have been paying estimated quarterly taxes all year, but didn’t, and now your tax bill is surprisingly high.

You meant to set some money aside in a retirement account, but that shocking tax bill meant you didn’t have any cash to do it.

You suspect that there were deductions you missed.

If you’re being honest, your books were a mess (if you’re thinking “I need to keep books?” go back and read this.)

Now that the time pressure is off, let’s take a look at how you can make this year better. Plus some discounts on apps that can help you.

Let’s tackle the worst one first: Estimated quarterly taxes. People with self employment income (Freelancers and artists!) are often shocked at how high their taxes are. The short answer here is self-employment tax. When your income comes in the form of a 1099 or from selling bespoke lingerie or topiary design services from your own business, that money is not just taxed at your income rate – it is further subject to 15.3% self-employment tax. This isn’t an injustice – employees who get a W2 also pay into the system, but they only have to pay 7.65%, and their employer, out of the employer’s pocket, pays a mirror-image 7.65%. When you’re self-employed, you are both employee and employer, so you pay both halves. And if you want to look deeper into the taxes on this, you even get the same discounts on the employer half that big employers do. It’s just that when you’re on your own, and presumably don’t have an HR or accounting department guiding you gently through this process, it hurts more to pay it.

Estimated quarterly taxes exist to approximate the tax withholding that happens with a regular paycheck. But of course, it’s on you to make it happen. The rules are this: if your total tax bill this April was over $1000 (don’t confuse this with the amount of your refund or the amount you owed – that’s just the part where you make change with the government from what you’ve been paying all year), then you are required to pay quarterly estimates this year. You may owe them for your state, too (those rules vary, and the amounts are smaller). The deadlines are:

- First payment due: tax day (today). April 18, 2017

- Second payment due: June 15, 2017

- Third payment due: September 15, 2017

- Fourth payment due: January 16, 2018.

If you don’t pay them over the course of the year, you will incur non-payment penalties and interest. Much scarier, you may face an outrageous tax bill come April, that you are unable to pay. Please avoid this, for your own health. Pay here. You can actually pay money in at any time – if you overpay, you can apply the excess to future quarterly payments or get it refunded. When you earn less money than you did in the prior year, you’ll owe less in quarterly payments. When you make more money, you’ll owe more. As with W2 withholding, it is proportional to the amount of income you earn. You’re not expected to predict your future income accurately down to the last dollar (that wouldn’t be fair). But as long as you pay 100% of what you owed in tax last year, you will not be penalized with fees or interest. However, you still may owe more tax – you settle up the total when you file your 2017 taxes in winter 2018.

There’s a start-up that I like, trying to ease this pain for freelancers, aptly called Painless1099. If you sign up with this link, AFC users will get a 15% discount. Basically, Painless1099 allows you to set up a bank account where you deposit your freelance income, and they set aside the correct amount of estimated tax, based on your actual numbers. They charge a modest per-transaction fee, with a yearly maximum fee of $125. If paying this small amount saves you from a financial disaster next tax day, it’s well worth it. This way, you don’t get blindsided by a huge tax bill in April.

Bookkeeping

I’ve addressed the need for bookkeeping before, but to recap, if you have self-employment income or run your own business, then you are required by law to keep accurate books recording your income and expenses. I don’t know one person on earth who doesn’t have a little room for improvement in this area. So if your system isn’t great, take some time now to retool it. A spreadsheet is fine if your business is simple. If not, consider bookkeeping software such as Quickbooks self-employed or Xero. Quickbooks has been making improvements, and their self-employed app is pretty good. But be forewarned that it is designed to feed you into other Intuit-owned products (like TurboTax), and so does not play well with other programs you might use. Xero is cloud-based and easy for an accountant or employee to log in to from another location. They are a more tech-forward company, and I like that they are quicker to make updates and their software is more intuitive. I am personally biased towards cloud-based bookkeeping software, as it eliminates problems of older software that won’t translate to your new computer, or vicious dilemnas caused by multiple bookkeepers working on separate files. I don’t recommend any version of the old Quickbooks desktop software.

Missing deductions

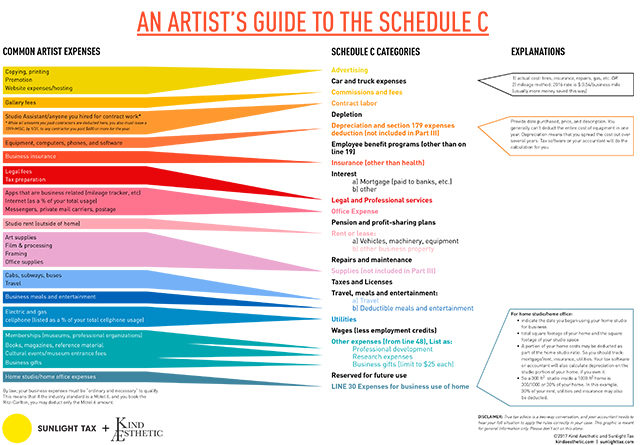

If you’ve been reading my column, you know that you need to keep receipts to back up any expenses you list on your Schedule C. This year, I worked with the artist professional development guides at Kind Aesthetic to create this lovely visual chart of what is deductible for an artist on the Schedule C (and where to put it).

Often, freelancers miss deductions they are entitled to because they aren’t aware that they are deductible. So to help you track some of the often-missed deductions, here are a couple apps (plus discounts).

Xero Taxtouch. This mobile-friendly app made for freelancers lets you hook up to your bank feed, and swipe left or right to categorize deductions as business expenses (deductible) or personal ones (not). It makes it easy to create a report at the end of the year to give to your accountant, and since it connects directly to your bank feed, it captures everything you spend.

Mileage is a deduction people often miss because they don’t track it. The IRS rules require you to keep a mileage log if you’re going to deduct your business mileage, and this rule scares a lot of people off. But the deduction is huge: 53.5 cents/mile for 2017. This means if you drive 100 miles to meet a client, you get a little over $50 of deduction. If you drive for your business at all, the money you save is worth the effort.

MileIQ is one of several mileage apps that use the location detection on your phone to automatically record your mileage. Similarly to Xero Taxtouch, you swipe left or right to categorize drives as business or personal. You can also track the things people often don’t – volunteer miles driven (deductible at 14 cents/mile, if you itemize) and medical miles driven (ditto, but 17 cents/mile, with a high threshold before it’s useful). The free version doesn’t capture everything, so it’s useful to get the full version. ArtFCity readers can get a 20% discount by using this code: HCOL124A

And in the service of having a better tax year next year, I built an online tax course with the help of Kind Aesthetic, specifically for artists. We worked hard to make it clear, accessible and empowering, and I think it’s a great tool to help artists realize their rights as small business taxpayers, and how to armor themselves with best practices. It’s one hour. (And it’s 20% off for AFC readers, using code: 2017MARCHAPRIL) Here’s the link.

And lastly, if you’re reading this in a sweat because you still haven’t filed your 2016 taxes, fear not. You can still file for an extension, as long as you make a payment for what you think you owe, and postmark it today. The extension deadline is only an extension of time to file, not an extension of time to pay. I hear you asking how you’re supposed to know what you owe before you file. Make a guesstimate based on last year’s tax due. If you underpay or don’t pay at all, and you expect to owe money, you’ll be charged interest and penalties until the day you file and pay. If you overpay, you’ll get a refund. Don’t forget to apply for an extension for your state, too.

And for everyone, today is your deadline to put money into a retirement account to credit towards tax year 2016. If you put money into a traditional IRA, it saves money on your taxes this year (so be sure it’s listed on your 2016 taxes!). If you put money into a Roth IRA, you don’t need to do anything on your tax forms, because there is no tax savings when you put it in – but when you take it out one day, it will be sweet and tax-free.

Let’s make 2017 your best tax year yet. Good luck everyone.

DISCLAIMER: True tax advice is a two-way conversation, and your accountant needs to hear your full situation to apply the rules correctly in your case. This post is meant for general information only. Please don’t act on this alone.

Bio: Hannah Cole is an artist and Enrolled Agent. She is the founder of Sunlight Tax.

Comments on this entry are closed.