Sotheby’s CEO and Chairman William Ruprecht is the man of the hour. Not for his deeds, but for his inability to change. At least, this is the portrait we’re led to believe about a man who is stepping down from his position after 14 years. In total, he has spent over 30 years of employment with the auction house. Though he is said to step down in “mutual agreement” with Sotheby’s, a bitter debate with the board, led by shareholder Daniel Loeb, has plagued his tenure since 2013.

In March 2014, Loeb’s hedge fund (and Sotheby’s stockholder) Third Point sued the auction house over a board-instituted “poison pill,” an action that effectively hindered Third Point from purchasing more than 10 percent in shares. At the time, Third Point held a 9.6 percent stake in Sotheby’s.

In May, Sotheby’s settled the suit, but only after spending more than $10 million in a court battle. Loeb’s various demands—which included the appointment of three new board members, himself included—allowed Third Point to increase its stake in Sotheby’s to 15 percent. By this point, the canard swirling about was not “if” Ruprecht would step down, but “when.”

Leading up to this suit were months of pressure from Loeb, who vocally insisted that the 277-year-old company needed to revamp its board and oust William Ruprecht. Sotheby’s was seen as unwilling to change, to innovate; this in a time when competitor Christie’s continues to wield an ever-increasing market share.

It’s difficult to discern whether the auction houses are netting a profit from these sales—many which are viewed as boutique events. But from the public’s point of view, seeing that Sotheby’s fall contemporary sale grossed $343.6 million compared to Christie’s record-setting $852.9 million, does shape opinions.

In fact, those associated with Sotheby’s rarely cite evening-sale numbers as a woe. Loeb, and other Sotheby’s directors, were more rankled by the chief executive’s compensation. As for the latest numbers, in 2013 Ruprecht received a total of $6.043 million in compensation. One Sotheby’s board member, Steven B. Dodge. was quoted as saying that his compensation was “red meat for the dogs.”

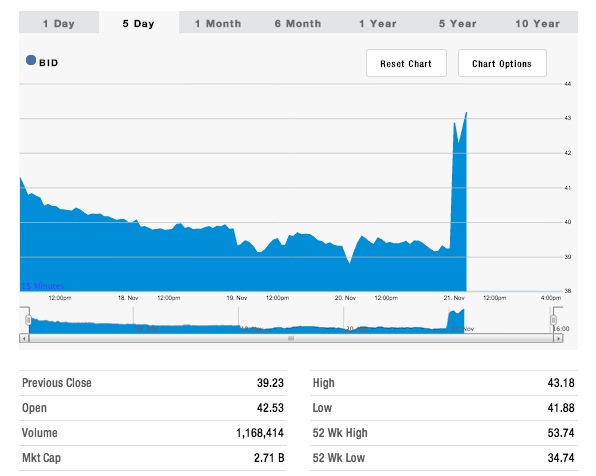

Since the announcement of Ruprecht’s departure, investor confidence has soared. Here’s how Sotheby’s performed on the New York Stock Exchange today:

According to a statement from Sotheby’s Ruprecht will stay on until his replacement is found.

Comments on this entry are closed.